Louisiana’s House Ways & Means Committee has formed a sub-committee as a result of a house-approved resolution brought during the 2022 Regular Legislative Session by Representative Richard Nelson (R-89). HR178 requested House Ways & Means Committee to form said subcommittee to study Louisiana’s tax structure for the purpose of making recommendations with respect to eliminating the state’s tax levied on individual and corporate income and reforming state tax exemptions and credits ahead of the state’s 2023 Regular Legislative Session which will be fiscal in nature.

The sub-committee, which is chaired by Representative Philip DeVillier (R-41), held its first meeting on Wednesday, October 12th. This was an introductory meeting to briefly outline each major tax type which serves as a revenue source for the State General Fund– personal income tax (PIT), corporate income tax (CIT), corporate franchise tax (CFT), insurance premium tax, sales and use tax, severance tax, gas tax, and gaming tax. Additionally, information on the excise taxes levied on tobacco and alcohol was presented. The presentation of the materials was provided by Allyson Pryor (House Ways & Means Staff), Drew Murry (House Ways & Means Staff), and Ashari Robinson (House Fiscal Division) with commentary from Chief Economist Deborah Vivien from Louisiana’s Legislative Fiscal Office and Secretary Kevin Richard from Louisiana’s Department of Revenue. The presentation provided foundational information on each tax type, specifically highlighting revenue collections, recent legislative changes, and additional structural components.

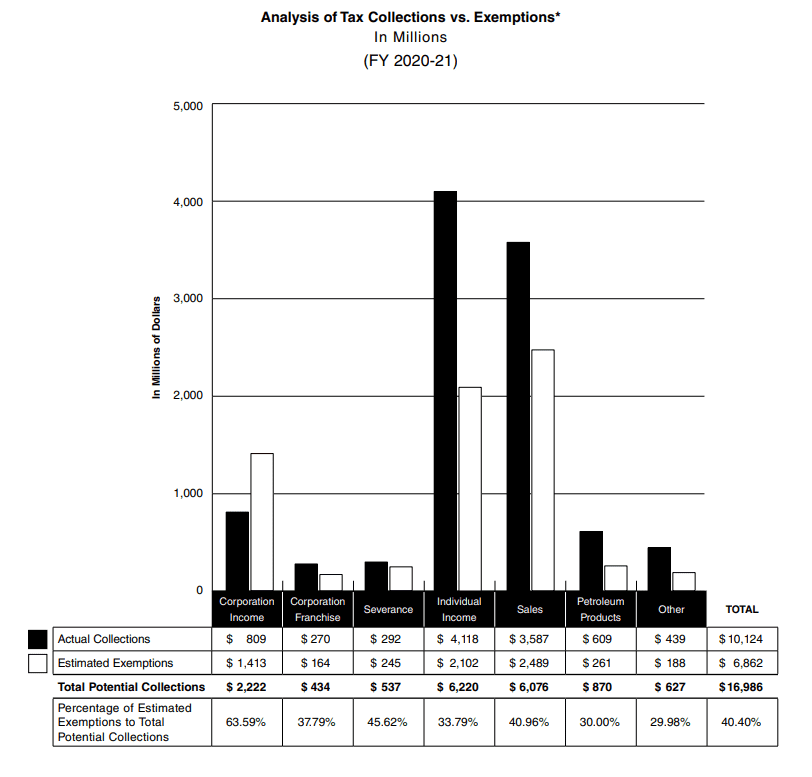

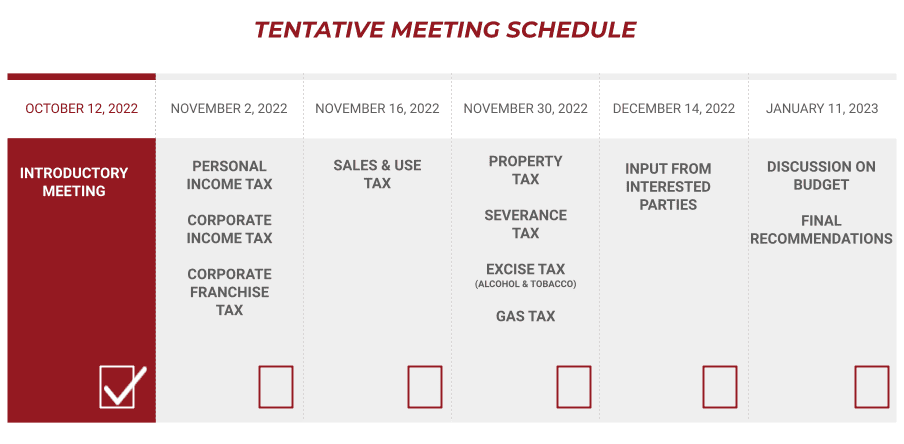

The sub-committee has outlined a tentative schedule for future meetings over the next few months. Throughout the series of meetings, each individual tax type will be studied and discussed at depth with the group specifically examining the state’s various tax expenditures (credits, exemptions, deductions, exclusions, rebates, etc.) compared to it’s tax collections. Concluding the series of meetings, the sub-committee will present final recommendations at its final meeting scheduled for mid-January.

The next sub-committee meeting is scheduled for Wednesday, November 2nd and will specifically pertain to personal income tax, corporate income tax, and corporate franchise tax. For any questions or concerns regarding this or any other legislative matters, please email mary.robinson@advantous.com.