Financial Tools

Pellentesque in ipsum id orci porta dapibus. Nulla porttitor accumsan tincidunt. Curabitur arcu erat, accumsan id imperdiet

We Are Always Here to Help, but We’ve Also Created a Bunch of Tools For You to Manage Your Finances On Your Own!

Aenean eu leo quam. Pellesque ornare sem lacinia quam venenatis vestibulum. Vestibulum id ligula porta felis euismod semper. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

Resources & Calculators

Useful Resources for Financial Management & Forecasting

401k Calculator

Cras ultricies ligula sed magna dictum porta. Nulla porttitor accumsan tincidunt. Pellentesque in ipsum id orci porta dapibus.

Interest Calculator

Cras ultricies ligula sed magna dictum porta. Nulla porttitor accumsan tincidunt. Pellentesque in ipsum id orci porta dapibus.

Retirement Planner

Cras ultricies ligula sed magna dictum porta. Nulla porttitor accumsan tincidunt. Pellentesque in ipsum id orci porta dapibus.

Payment Manager

Cras ultricies ligula sed magna dictum porta. Nulla porttitor accumsan tincidunt. Pellentesque in ipsum id orci porta dapibus.

Resources

Other Tools & Resources

Debt & Credit Cards

Retirement

Insurance

Savings

Invetsments

Taxes

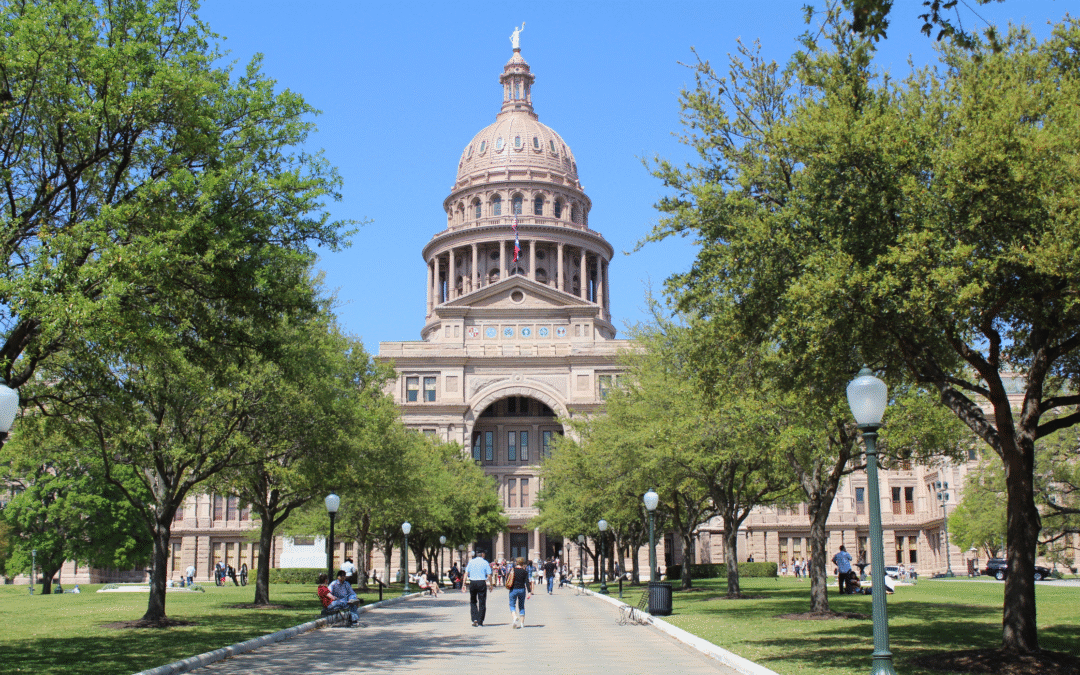

Texas Legislative Session Update

2025 Texas Legislative Session Wrap-Up: Key Tax Legislation and Developments

The 89th Texas Legislature adjourned its regular session on June 2, 2025, after a whirlwind of policy debates and negotiations. One of the most impactful outcomes of this session was a series of sweeping changes to the state’s tax landscape, particularly in the areas of property taxes, business incentives, and severance tax allocations. Below is a detailed breakdown of the major tax bills passed and what they mean for Texas taxpayers—both individuals and businesses.

Louisiana Legislative Session Update Blog

Here is a brief update on what has happened this week as of June 3rd, 2025:

Both House Committee on Ways and Means and Senate Committee on Revenue and Fiscal Affairs announced yesterday that the committees are adjourned for the remainder of session. As such, any bill committed to these committees that have not been heard and/or voted on will not move forward for the remainder of session.

In similar news, the proposed rate cuts to individual income tax and state sales and use tax will not be moving forward this session.

HB 667 by Representative Emerson proposed to reduce the rate of individual income tax from 3% to 2.75% for taxable periods beginning January 1, 2027. This rate cut was contingent on the passage of HB 678 by Representative Emerson, the constitutional amendment that, if passed, will merge the Revenue Stabilization Fund and its dedications into the Budget Stabilization Fund. The intent was to use the excess revenue from the merger to lower both the individual income tax rate and state sales and use tax rate. HB 667 by Representative Emerson was committed to the Senate Committee on Revenue and Fiscal Affairs but was not timely heard before its final adjournment.

HB 578 by Representative Emerson proposed to accelerate the rate reduction to the state sales and use tax from 5% to 4.75% beginning January 1, 2027, also contingent on the passage of HB 678 by Representative Emerson for the reasons stated above. This reduction was previously set in the Special Session to occur in 2030. On Sunday, HB 578 by Representative Emerson was amended in Senate Committee on Revenue and Fiscal Affairs to remove the accelerated rate reduction. The amendment was adopted on the Senate floor and the bill is now pending Senate Committee on Finance.

The failure of these rate reductions was likely due to budgetary implications and fiscal note concerns. The fiscal note for HB 667 estimated that the rate reduction to the individual income tax rate would result in a decrease in revenue to the State General Fund of approximately $600 million over the next five years. Similarly, the fiscal note for HB 578 estimated that the reduction to the state sales and use tax rate would result in a decrease in revenue to the State General Fund of approximately $800 million over the next five years.

Contact Us

Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia Curae; Donec velit neque, auctor sit amet aliquam vel, ullamcorper sit amet ligula.