Financial Tools

Pellentesque in ipsum id orci porta dapibus. Nulla porttitor accumsan tincidunt. Curabitur arcu erat, accumsan id imperdiet

We Are Always Here to Help, but We’ve Also Created a Bunch of Tools For You to Manage Your Finances On Your Own!

Aenean eu leo quam. Pellesque ornare sem lacinia quam venenatis vestibulum. Vestibulum id ligula porta felis euismod semper. Cras justo odio, dapibus ac facilisis in, egestas eget quam.

Resources & Calculators

Useful Resources for Financial Management & Forecasting

401k Calculator

Cras ultricies ligula sed magna dictum porta. Nulla porttitor accumsan tincidunt. Pellentesque in ipsum id orci porta dapibus.

Interest Calculator

Cras ultricies ligula sed magna dictum porta. Nulla porttitor accumsan tincidunt. Pellentesque in ipsum id orci porta dapibus.

Retirement Planner

Cras ultricies ligula sed magna dictum porta. Nulla porttitor accumsan tincidunt. Pellentesque in ipsum id orci porta dapibus.

Payment Manager

Cras ultricies ligula sed magna dictum porta. Nulla porttitor accumsan tincidunt. Pellentesque in ipsum id orci porta dapibus.

Resources

Other Tools & Resources

Debt & Credit Cards

Retirement

Insurance

Savings

Invetsments

Taxes

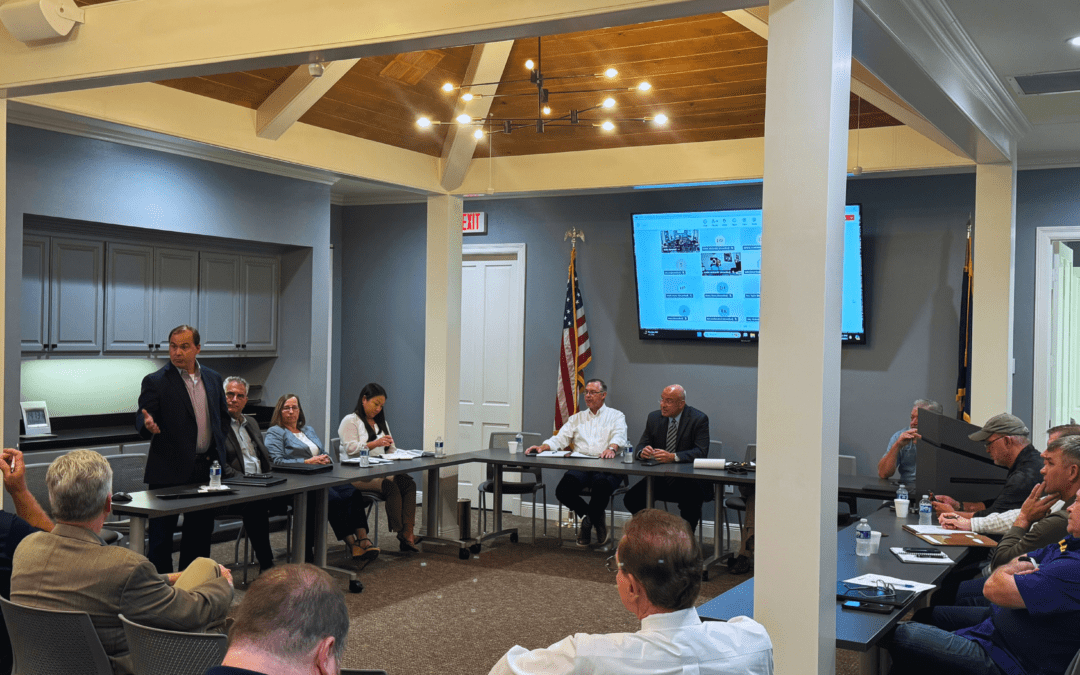

Louisiana Assessors’ Association ITEP Committee Meeting

Advantous Co-Owner and Partner, Jimmy Leonard, was honored to represent business and industry while presenting new ideas to help streamline the ITEP program during the Louisiana Assessors' Association ITEP Committee meeting.

Louisiana Chemical Association/Louisiana Mid-Continent Oil and Gas Association Gov. Affairs Post-Session Meeting

Advantous Co-Owner and Partner, Jason DeCuir, was invited to present at the Louisiana Chemical Association (LCA)/Louisiana Mid-Continent Oil and Gas Association Government (LMOGA) Affairs Post-Session Meeting. His presentation focused on Louisiana's current tax...

Contact Us

Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia Curae; Donec velit neque, auctor sit amet aliquam vel, ullamcorper sit amet ligula.