Louisiana Credits & Incentives Update

LED recently submitted its Summary Report to the Louisiana Legislative oversight committees regarding the proposed ITEP Rules published in the LA Register on 12/20/2024. LED will formally publish the new ITEP Rules in the LA register, effective 3/20/2025. This update was given publicly at the February meeting of the Louisiana Board of Commerce & Industry (BCI).

Prior to this, LED held a public hearing January 30, 2025. The verbal comments received in the public hearing were positive and appreciative in nature with no additional recommendations received. No written comments were received on the Notice of Intent.

Notable Features of the proposed new ITEP rules are:

- Maintains 80% as the standard exemption

- Includes Mega Project Qualifications

- Eligible for a 93% to 100% exemption

- Capital Expenditures must be 200 percent of the 10-year Parish Average, or Regional or Statewide if none exists

- LED to update and post parish, regional, and statewide ITEP statistics on its website

- Affidavits of Final Cost and Annual Project Property Reports will be used to establish the statistics

- Exemption percentage to be negotiated with the Local ITEP Committee

- Eligible for a 93% to 100% exemption

- Job and payroll commitments

- New applicants do not have job and payroll commitments

- Existing contract holders may request the Board to remove job and payroll commitments from Exhibit A beginning with Project Year 2025 commitments.

- 2024 Project Year commitments shall remain in effect

- 2024 job and payroll compliance reports will be due in April 2025

- Recognition of payments under protest

- Acknowledges the process as a means to preserve exemption eligibility.

- Expanded site description

- Will be required to supply legal descriptions

- No MCAs

- ALL capital expenditures associated with the project as defined on the ITEP application that reside at the site shall be eligible for the exemption.

- There are many new definitions; i.e. Maintenance Capital, Sustaining Capital Expenditures, Proactive Environmental Upgrades, and Miscellaneous Capital Additions, all of which help to better define and expand eligible project costs from the 2016 JBE executive orders.

- Pollution control expenditures are eligible if the expenditure meets the definition of a “Proactive Environmental Capital Upgrade”.

- Upgrades required by any state or federal government agency, as a result of an enforcement action by said agency will remain ineligible.

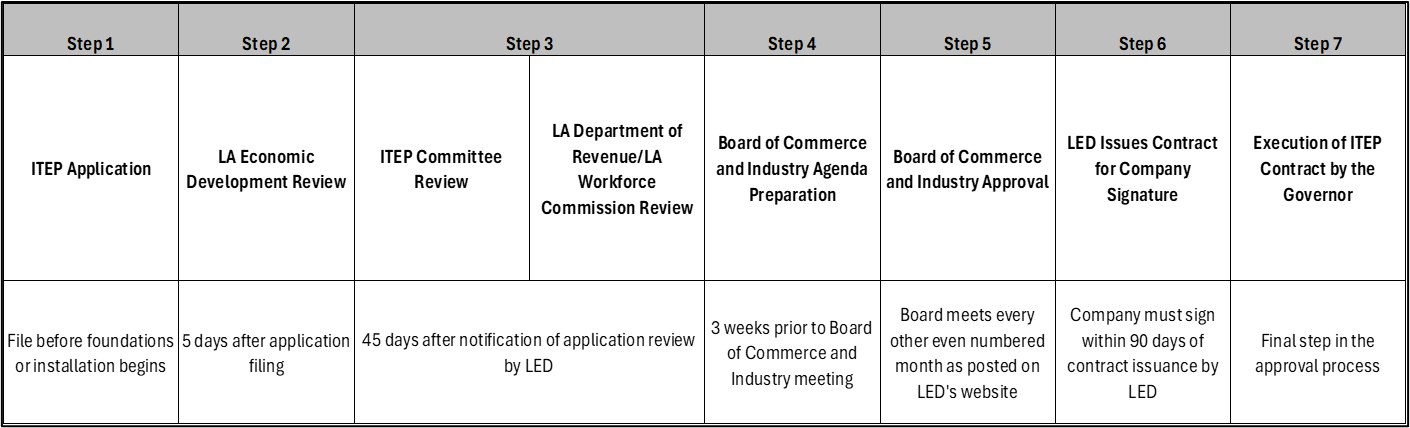

- The application process is more streamlined:

- Three weeks quicker from application filing to BCI approval

- Local ITEP Committee process occurs prior to BCI meeting

9. Local ITEP Committee

-

- “One stop shop” vs. meetings at all affected local bodies

- Local ITEP committees are not required to be established

- No committee = No response = only BCI and Governor approval required

- Voting committee members include representatives from:

- School Board

- Parish

- Mayor

- Sheriff

- Non-voting committee members:

- Economic development representative

- May act as a committee organizer/facilitator

- Assessor

- Economic development representative

10. Annual Project Property Report Replaces:

- Project Completion Report

- Affidavit of Final Cost

- Phased Applications

- Annual Project Status Report

Purpose:

- To provide a project update to LED

- To document exempted assets

- To establish an exemption term for an asset or group of assets

Notes:

- Must file annually even if no assets have been in placed in service

- Should include the assets that were placed into service during the prior year (non-cumulative)

- Can be amended

- The exemption period can extend beyond the term of the ITEP contract

MAJOR Takeaways in new proposed ITEP Rules:

- Streamlined

- Flexible

- Simplified compliance

- Retains local input

- Retains Board and Governor authority

- No job and payroll commitments for new project

- Option to opt out of jobs and payroll commitments for ITEP Contracts under the 2017 & 2018 ITEP Rules

Upcoming Deadlines

- March 31st – Industrial Tax Exemption Program Phased Applications

- April 1st – Louisiana Property Tax Renditions

- Jefferson Parish deadline is 45 days after receipt of LAT forms from the parish

- April 30th – Industrial Tax Exemption Program Annual Certification of Compliance Reports

- May 1st – Industrial Tax Exemption Program Annual Report (Pre JBE executive order contracts only)

- May 31st – Louisiana Enterprise Zone Program Employee Certification Reports

- June 30th – Louisiana Quality Jobs Program Annual Compliance Reports